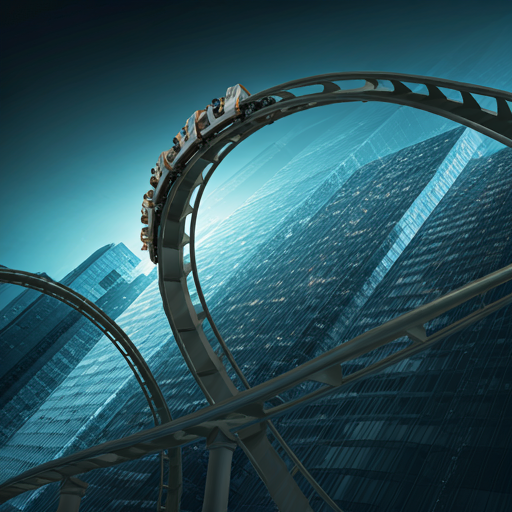

Navigating the Stock Market Rollercoaster: Tips for Investors

What is Market Volatility?

Market volatility refers to the degree of variation in trading prices over time. It is a critical concept for investors, as it indicates the level of risk associated with a particular asset. High volatility often signals uncertainty in the market, which can trail to significant price swings. Investors must be prfpared for these fluctuations. Understanding volatility helps in making informed decisions. It is essential to analyze historical data and market trends. This analysis can reveal patterns that may predict future movements. Knowledge is power in investing. Volatility can create both opportunities and risks. Investors should remain vigilant and adaptable.

Historical Trends in Market Fluctuations

Historical trends in market fluctuations reveal significant patterns that can inform investment strategies. For instance, during economic recessions, stock prices often experience sharp declines. This correlation underscores the impact of macroeconomic factors on market behavior. Investors should analyze past downturns to anticipate future risks. Understanding these cycles is crucial for effective portfolio management. Historical data can also highlight recovery periods, which often follow significant declines. Timing the market can be challenging. However, recognizing these trends can enhance decision-making. Investors must remain aware of external influences. Knowledge of history can guide future actions.

Factors Contributing to Volatility

Several factors contribute to market volatility, significantly impacting investor behavior. Economic indicators, such as unemployment rates and inflation, can create uncertainty. This uncertainty often leads to rapid price changes. Additionally, geopolitical events, like elections or conflicts, can disrupt market stability. Investors should monitor these developments closely. Market sentiment, driven by news and social media, also plays a crucial role. Emotional reactions can amplify price movements. Furthermore, changes in interest rates can influence investment decisions. Higher rates typically lead to lower stock prices. Understanding these factors is indispensable for navigating market fluctuations. Awareness is key to informed investing.

Volatility in cryptocurrency markets often surpasses that of traditional stocks. This heightened volatility is primarily due to lower market capitalization and regulatory uncertainty. Investors should be aware of these differences. Additionally, cryptocurrencies are influenced by technological developments and market sentiment. Rapid price swings can occur within short timeframes. In contrast, traditional stocks tend to exhibit more stability, driven by established financial metrics. However, they are not immune to volatility, especially during economic downturns. Understanding these dynamics is crucial for informed investment decisions. Knowledge empowers investors to navigate risks effectively.

Investment Strategies for Turbulent Times

Diversification: Spreading Your Risk

Diversification is a fundamental strategy for managing investment risk. By spreading investments across various asset classes, an investor tin mitigate potential losses. This approach reduces the impact of poor performance in any single investment. For instance, combining stocks, bonds, and real estate can cdeate a balanced portfolio. Each asset class reacts differently to market conditions. Therefore, diversification can enhance overall returns while minimizing volatility. Investors should also consider geographic diversification. Investing in international markets can provide additional opportunities. A well-diversified portfolio is more resilient. It can withstand market fluctuations more effectively.

Long-Term vs. Short-Term Investing

Long-term investing focuses on holding assets for several years, aiming for substantial growth. This strategy benefits from compounding returns over time. Investors often choose stable companies with strong fundamentals. In contrast, short-term investing seeks quick profits from market fluctuations. This approach requires active monitoring and quick decision-making.

Key differences include:

Understanding these strategies is essential. Each has its own merits and challenges. Investors should align their approach with their financial goals. Awareness is crucial for success.

Using Stop-Loss Orders Effectively

Using stop-loss orders effectively can significantly enhance an investor’s risk management strategy. These orders automatically sell a security when it reaches a predetermined price. This mechanism helps limit potential losses in volatile markets. Investors should carefully determine their stop-loss levels based on market conditions and individual risk tolerance. A well-placed stop-loss can protect gains while minimizing losses.

For example, setting a stop-loss at 10% below the purchase price can safeguard against significant downturns. He should also consider market trends when establishing these levels. Additionally, trailing stop-loss orders can adjust automatically as the price increases. This feature allows for profit protection while still enabling upside potential. Awareness of these tools is essential for effective trading. Knowledge empowers investors to make informed decisions.

Rebalancing Your Portfolio

Rebalancing a portfolio is a crucial strategy for maintaining desired risk levels. Over time, certain assets may outperform others, leading to an unbalanced allocation. This imbalance can expose an investor to higher risks than intended. Regularly reviewing and adjusting the portfolio helps realign it with investment goals. He should consider rebalancing at least annually or after significant market movements.

For instance, if equities have surged, he may need to sell some shares to reinvest in underperforming assets. This practice can enhance long-term returns. Additionally, rebalancing can help mitigate emotional decision-making during market fluctuations. It encourages a disciplined approach to investing. Awareness of portfolio composition is vital for effective management. Knowledge leads to better investment outcomes.

Emotional Resilience in Investing

The Psychology of Investing

The psychology of investing plays a significant role in decision-making. Emotional resilience is essential for navigating market fluctuations. Investors often face fear and greed, which can cloud judgment. He must recognize these emotions to make rational choices. Research shows that emotional responses can lead to impulsive actions, such as panic selling. A disciplined approach can mitigate these risks.

Developing a long-term perspective helps maintain focus during volatility. He should remind himself of his investment goals. Additionally, practicing mindfulness can enhance emotional control. This practice encourages thoughtful responses rather than reactive ones. Understanding the psychological aspects of investing is crucial for success. Awareness fosters better decision-making and improved outcomes.

Managing Fear and Greed

Managing fear and greed is essential for successful investing. These emotions can lead to irrational decisions, impacting long-term performance. He must recognize when fear drives him to sell prematurely. Similarly, greed can cause him to chase high-risk investments. Establishing a clear investment strategy can help mitigate these impulses.

Setting specific goals provides a framework for decision-making. He should regularly review his portfolio to stay aligned with these goals. Additionally, practicing emotional awareness can enhance self-control. Mindfulness techniques can help him remain calm during market fluctuations. Understanding these psychological factors is crucial for maintaining emotional resilience. Awareness leads to more informed investment choices.

Staying Disciplined During Market Swings

Staying disciplined during market swings is vital for long-term success. Emotional reactions can lead to impulsive decisions, which often result in losses. He should adhere to a well-defined investment strategy. This strategy should include clear entry and exit points.

Key practices include:

By focusing on these practices, he can minimize emotional trading. Additionally, setting predetermined stop-loss orders can help enforce discipline. This approach allows for a systematic response to market changes. Awareness of his emotional state is crucial. Knowledge fosters better decision-making during turbulent times.

Mindfulness Techniques for Investors

Mindfulness techniques can significantly enhance an investor’s emotional resilience. By practicing mindfulness, he can develop greater awareness of his thoughts and feelings. This awareness helps in recognizing emotional triggers that may lead to impulsive decisions. Techniques such as deep breathing and meditation can promote calmness during market volatility.

Incorporating regular mindfulness sessions into his routine can improve focus. He should also consider journaling to reflect on his investment experiences. This practice encourages thoughtful analysis of past decisions. Additionally, visualization techniques can help him imagine successful outcomes. These methods foster a positive mindset. Awareness is key to maintaining discipline. Knowledge empowers better investment choices.

Leveraging Technology and Tools

Using Trading Platforms and Apps

Using trading platforms and apps can raise an investor’s efficiency and decision-making. These tools provide real-time data and analytics, allowing for informed choices. He can access market trends and price movements instantly. This immediate information is crucial for timely trading decisions.

Analyzing Market Data and Trends

Analyzing market data and trends is essential for informed investing. By examining historical price movements, he can identify patterns that may predict future behavior. Utilizing technical indicators, such as moving averages and RSI, enhances this analysis. These tools provide insights into market momentum and potential reversals.

He should also consider fundamental analysis, which evaluates a company’s financial health. This approach includes reviewing earnings reports and economic indicators. Combining both methods can lead to more robust investment strategies. Awareness of market sentiment is equally important. Understanding how news affects prices can guide decision-making.

Automated Trading Bots: Pros and Cons

Automated trading bots offer several advantages for investors. They can execute trades at high speeds, capitalizing on market opportunities. This efficiency reduces the emotional stress associated with trading. He can set specific parameters for the bot to follow. However, there are also drawbacks to consider.

For instance, bots may not adapt well to sudden market changes. This limitation can lead to significant losses. Additionally, reliance on automation can diminish an investor’s market knowledge. He should remain engaged with market trends. Understanding the underlying strategies is crucial for success. Awareness of both pros and cons is essential. Knowledge leads to informed decisions.

Staying Informed with News Aggregators

Staying informed with news aggregators is essential for effective investing. These platforms compile information from various sources, providing a comprehensive view of market developments. He can quickly access relevant news articles and analysis. This efficiency allows for timely decision-making.

Key benefits include:

However, he should critically evaluate the sources. Not all information is reliable. Understanding the context of news is crucial. Awareness of market sentiment can influence investment strategies. Knowledge is vital for navigating the financial landscape.

Future Trends and Predictions

Emerging Technologies in Finance

Emerging technologies in finance are reshaping the industry landscape. Innovations such as blockchain, artificial intelligence, and machine learning are driving efficiency and transparency. Blockchain technology enhances security and reduces transaction costs. He can expect faster settlements and improved traceability of assets.

Key trends include:

These advancements enable more informed decision-making. However, he should remain aware of regulatory challenges. Understanding the implications of tuese technologies is crucial. Knowledge of future trends can provide a competitive edge . Awareness fosters better investment strategies.

Impact of Regulatory Changes

The impact of regulatory changes on financial markets is significant. New regulations can alter market dynamics and investor behavior. He must stay informed about these changes to adapt his strategies. For instance, stricter compliance requirements can increase operational costs for firms. This may lead to reduced profitability in the short term.

Key considerations include:

These factors can influence market volatility and investor confidence. He should analyze how regulations affect specific sectors. Understanding these implications is crucial for informed decision-making.

Cryptocurrency’s Role in the Future Market

Cryptocurrency is poised to play a significant role in future markets. As digital assets gain acceptance, they may become mainstream investment options. He should consider the potential for cryptocurrencies to diversify portfolios. Their decentralized nature offers an alternative to traditional financial systems.

Key factors influencing this trend include:

These elements can enhance market stability and investor confidence. Additionally, cryptocurrencies may facilitate faster and cheaper transactions. He must stay informed about technological advancements. Understanding these dynamics is crucial for strategic investment decisions. Awareness leads to better opportunities in the evolving market.

Preparing for the Next Market Cycle

Preparing for the next market cycle requires strategic foresight and analysis. Investors should assess current economic indicators to identify potential shifts. Key indicators include interest rates, inflation, and employment data. Understanding these factors can provide insights into market trends.

He should also consider diversifying his portfolio across asset classes. This approach can mitigate risks associated with market fluctuations. Additionally, maintaining liquidity is essential for seizing opportunities during downturns.

Regularly reviewing investment strategies is crucial. He must adapt to changing market conditions. Awareness of historical cycles can inform future decisions. Knowledge is vital for navigating the complexities of investing.